25% coverage in rural areas by Altnets should convince Ofcom to include ‘Area 3’ in its analysis of Equinox 2 pricing enquiry

The benefits of competition in the UK’s broadband sector have been starkly illustrated by the latest annual review from INCA, which has been published today (17 May 2023).

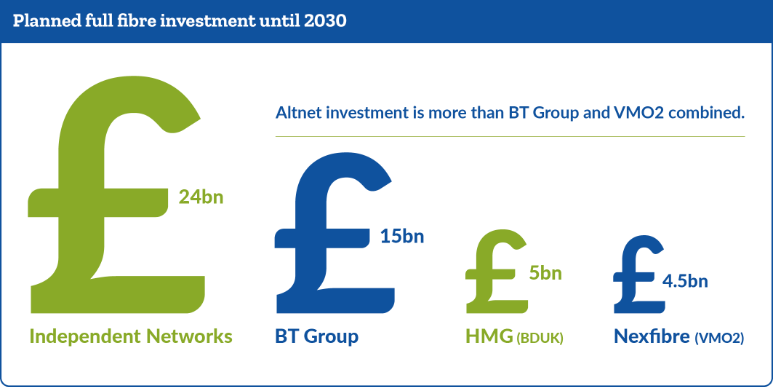

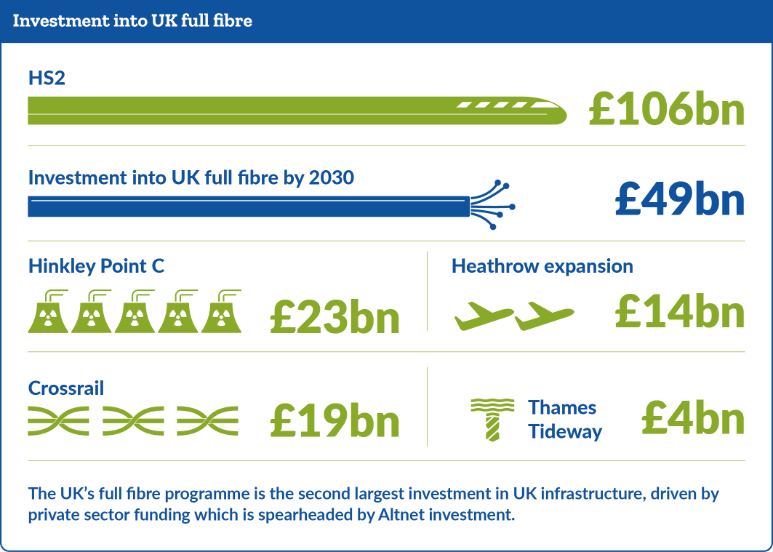

Private investment continued to flow into the independent network sector over the past year despite the challenging economic conditions and increasing interest rates. Planned investment to 2030 has increased to £24bn. This is more investment than BT Group and Virgin Media/O2 combined, whose own investments and deployments have been spurred on by competition from the Altnets. Taken altogether, planned full fibre investment until 2030 is only beaten by HS2 as the UK’s biggest infrastructure investment programme.

“Recent comments by the BT Group CEO indicate that the incumbent operator is feeling the challenge from independent providers”, said INCA Chair Tim Stranack. “It’s vital that the regulator provides an environment in which infrastructure competition can flourish in order to make full fibre available to more UK consumers and also deliver upon the strategic priorities set by government to Ofcom”, he continued.

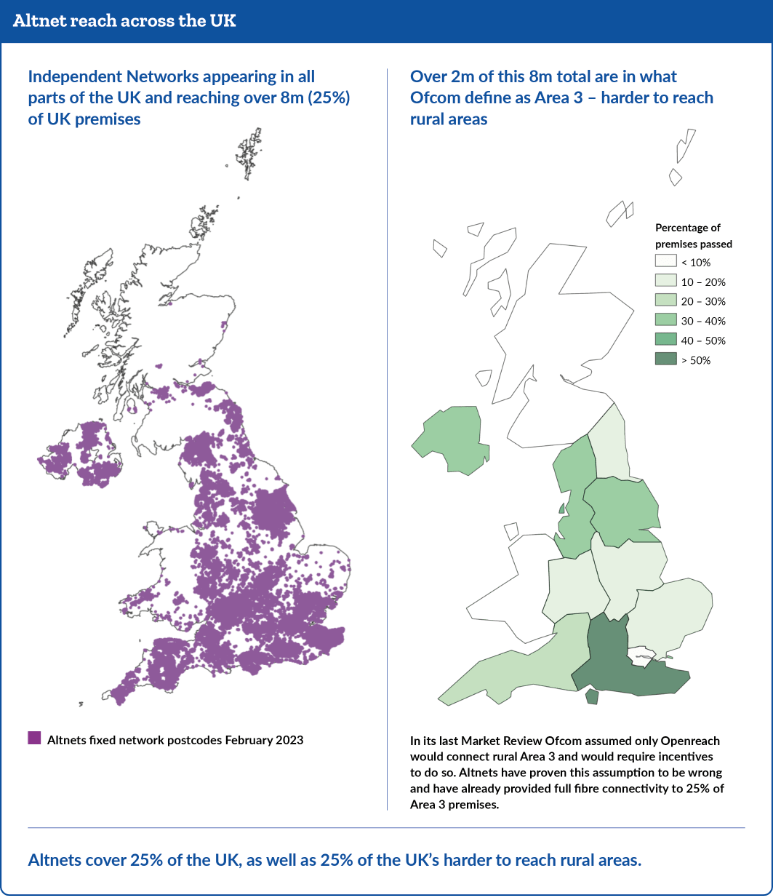

The report reveals that approximately 25% of the UK is now able to receive full fibre broadband from an independent supplier, with over 2m properties in harder-to-reach rural areas now also being passed by altnet fibre networks, something Ofcom assumed was not possible in its last market review. INCA believes this evidence should convince the regulator to include an impact analysis of the UK’s harder to reach areas, described by Ofcom as Area 3, in its final decision on Openreach’s Equinox 2 pricing proposal.

“As this year’s survey results clearly show, Ofcom must assess the potential impact of Equinox 2 on Area 3”, INCA CEO Malcolm Corbett said. “Equinox 2 is a live and pressing concern. It has the potential to unfairly foreclose the wholesale market, including in areas where Ofcom mistakenly thought only Openreach might get to, but where it is abundantly clear that Altnets are investing significantly and where they are already making full fibre broadband services available to millions of people. Ofcom must not put this investment at risk and jeopardise the digital transformation of small towns and rural areas in the UK.”

Key insights from the 2023 report include:

- Altnet operators had passed 8.2 million premises with fibre by the end of 2022. This is approximately 25% of UK premises

- 2.3 million of these premises were in Area 3, meaning that Altnets have delivered full fibre connectivity to a quarter of UK premises in hard-to-reach areas

- There are 1.5 million live connections (48% growth year-on-year) to independent fixed networks provided by full fibre gigabit capable connections

- Investment and expenditure in the independent network sector continued throughout 2022 with an estimated additional £6 billion having been committed to network expansions and operations during the year

- Estimated planned CAPEX spend by Altnets until the end of 2030 at over £24.2 billion is higher than that of BT Group’s (Openreach) £15 billion and Nexfibre’s (a joint venture between Liberty Global, Telefónica and InfraVia Capital Partners) £4.5 billion combined.

The 2023 ‘Metrics for the UK independent network sector’ report has been produced in partnership between INCA and broadband market intelligence specialists Point Topic, drawing on input from both INCA members and non-members. It provides an overview of the UK’s independent network operator sector as of end-2022 and early 2023 in terms of scale, coverage, ambitions, and concerns. As in the previous three years, it includes both fixed and fixed wireless network operators.

Download the 2023 report – Metrics for the UK Independent Network Sector – in full